Staking Process

Read this article to understand the staking rules and delegation lifecycle on Sui.

Staking on Sui

Sui is a proof-of-stake protocol, meaning validators' chances of winning block production are associated with a higher stake. Each Sui validator maintains its own staking pool, consisting of the validator's stake and the number of delegations hoping to get staking rewards paid at the end of each epoch (roughly 24 hours). The voting power of a validator in the Sui Network is determined by the amount of stake delegated to it by Sui accounts.

Staking is a legal way to earn money on Sui for validators (accounts that run a node and are in the validator set) and their delegators. For the blockchain, on the other hand, staking is a way to support the SUI token since the staked amount remains locked during the staking period.

Validator Requirements and Staking Rules

Sui maintains a validator set - a pool of nodes with enough stake to participate in Consensus and earn rewards. Sui imposes minimum staking requirements a validator must meet to enter the validator set:

- 30 million SUI of stake to join the validator set;

- If a validator's stake in the validator set falls below 20 million SUI, it gets "At Risk" status. It has seven epochs to make things right and add up to its stake. If the validator fails to do so, it gets removed from the validator set at the end of the current epoch

- If a validator's stake in the validator set falls below 15 million SUI, it is removed from the validator set at the end of the current epoch.

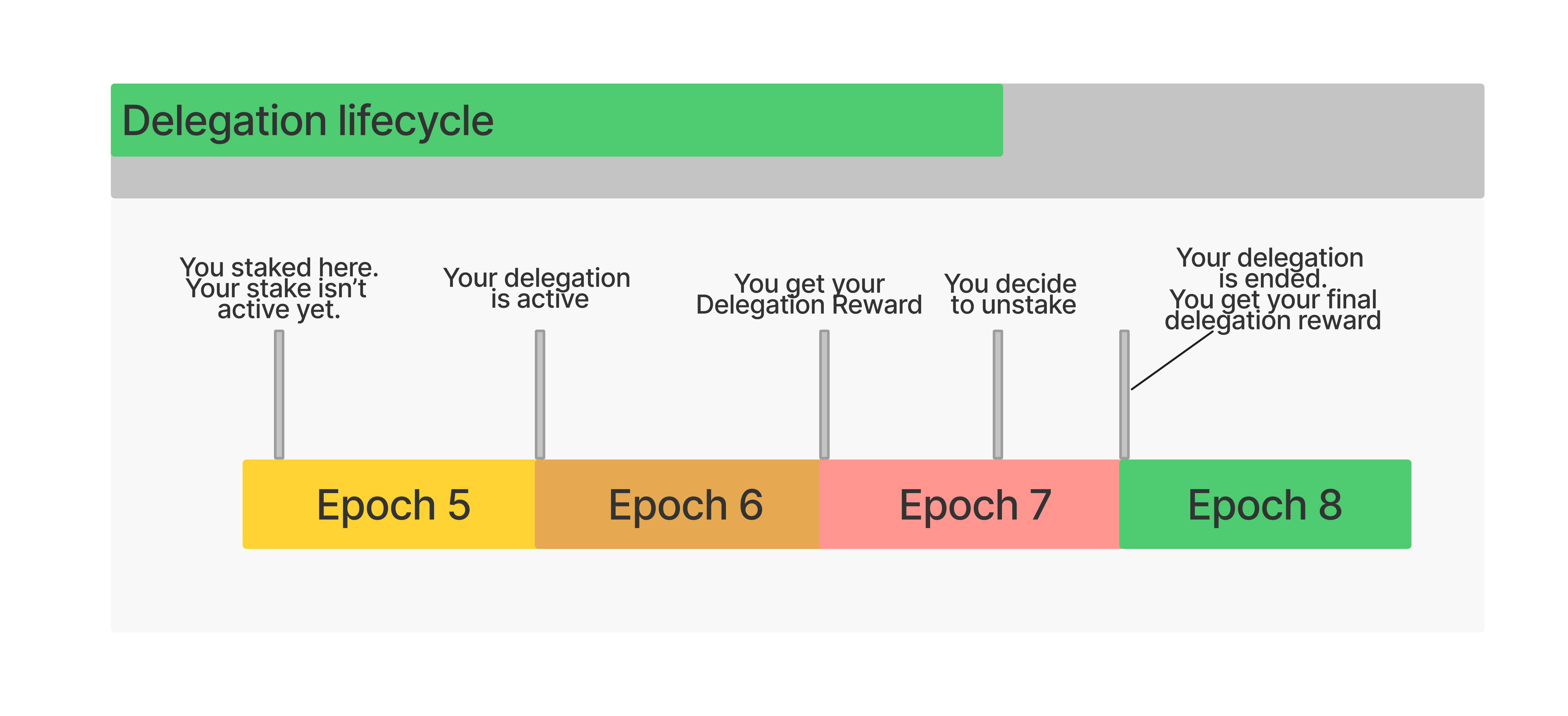

Staking and Unstaking

To stake SUI, an address has to send a staking transaction that calls the staking function implemented as part of the system Move package, which wraps the SUI coins in a stake object specifying the validator staking pool ID and the activation epoch.

Similar to staking, to unstake, or withdraw stake from a validator, one calls the unstaking function in the system Move package, which unwraps the stake object, and sends both the principal and the accumulated rewards to the delegating account. Rewards are accrued only during epochs where the stake is active for the entire epoch.

Staked SUI amount is locked for the entire epoch. Sui accounts can withdraw their delegation or redelegate to another validator no earlier than the end of the current epoch.

Staking Process

- At the beginning of each epoch:

- Sui accounts delegate their SUI funds to validators, and a new committee is formed.

- The reference gas prices are set based on validators' gas price quotes submitted in the previous epoch.

- The storage fund size is adjusted using the net inflow of the previous epoch.

- The Protocol computes the total staking amount as the sum of validators' staking pools plus the storage fund.

- During each epoch:

- Sui accounts send transactions, and validators process them. Accounts pay the associated computation and storage gas fees for transaction processing. In cases where users delete previous transaction data, users obtain a partial rebate of their storage fees (for more information on Sui gas fees, go here).

- Validators submit gas prices to determine the reference gas price for the next epoch.

- Validators observe the behavior of other validators and evaluate each other's performance. In case some validators behave maliciously or show bad uptime, they can be reported, resulting in slashing and/or removing such malicious validators from the validator set.

- At the end of each epoch, the Protocol distributes staking rewards both to validators and delegators. Read how staking rewards are calculated here.

On Sui, staking rewards do not add up to the staking amount, which remains unchanged for the period of staking, while the staking rewards accrue on a separate object. To withdraw staking rewards, you have to unstake. As you unstake, you get your delegation amount back plus all the rewards you've received.

For more information on the reference gas price and the tallying rule, go here. The diagram below illustrates the staking lifecycle on Sui.

Liquid Staking

Liquid staking is now available on Sui, bringing more opportunities to stakers. The staking amount is similar to regular staking and can't be transferred. Naturally, it can't be used to bring yields other than staking rewards. With liquid staking, stakers receive LST tokens in return for the staked tokens. Later, these LST tokens can be locked with a DeFi or a liquidity pool to produce more yields. Staking rewards and yields for locking LST tokens make up compound rewards, in which case a staker earns considerably more than with regular staking.

Liquid staking resembles derivatives on stock markets - securities that are wrapped and reused multiple times which allows profit multiplication.

Sui already has liquid staking protocols to consider: Aftermath, Volo, Haedal, and more. In 2023, Sui allocated 25 mln SUI tokens on LST projects.

Updated 4 months ago